Inventory Write-Off at Business Closure: Accounting Entry To Write Off Inventory When Business Closes

Accounting entry to write off inventory when business closes – Closing a business necessitates a thorough accounting process, including the crucial step of writing off remaining inventory. This involves recognizing the loss in value of unsold goods and adjusting financial records accordingly. Understanding the accounting procedures and implications of inventory write-offs is essential for accurate financial reporting and tax compliance during business closure.

Identifying the Inventory Write-Off Scenario

Writing off inventory when a business closes represents a significant financial event, impacting various aspects of the company’s financial statements. The value of unsold inventory, once considered an asset, is recognized as a loss. This loss directly reduces the business’s overall profitability and equity. Several inventory types may require write-offs, including raw materials, work-in-progress (WIP) goods, and finished goods.

The specific inventory needing write-off depends on the nature of the business and the circumstances of its closure. Legally, proper documentation of the write-off process is crucial, ensuring compliance with tax regulations and providing evidence of the loss for potential insurance claims or creditor negotiations. Failure to accurately account for inventory write-offs can lead to financial misreporting and potential legal ramifications.

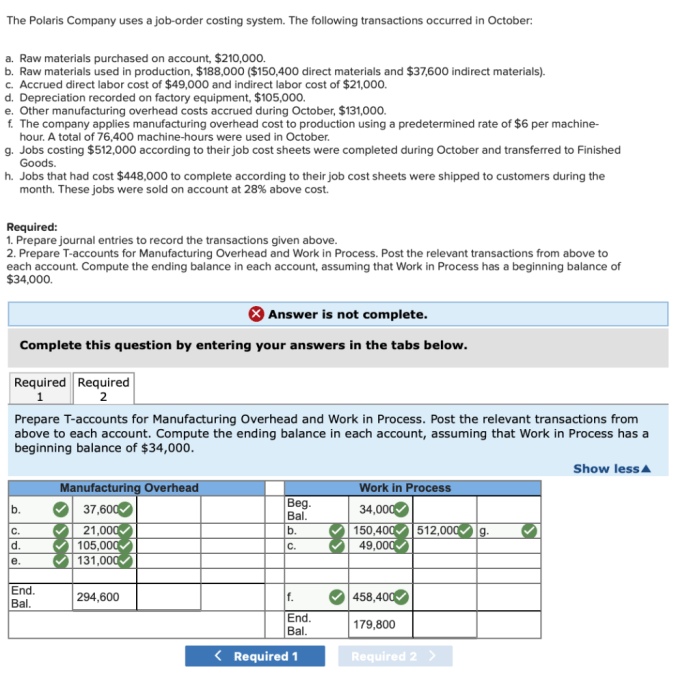

Accounting Methods for Inventory Write-Off

Source: cheggcdn.com

Several accounting methods exist for recording inventory write-offs, each with its own implications for financial reporting and tax liabilities. The direct write-off method directly reduces the inventory account and recognizes the loss on the income statement. The allowance method, on the other hand, establishes a contra-asset account to record estimated losses, gradually adjusting the inventory value over time. The choice of method influences how the write-off is reflected on the financial statements and impacts tax deductions.

For instance, using the direct write-off method may lead to a larger tax deduction in the year of closure, while the allowance method spreads the deduction over several periods.

| Method Name | Advantages | Disadvantages | Applicability |

|---|---|---|---|

| Direct Write-Off | Simple, straightforward process; immediate tax deduction. | Can distort financial statements in the year of the write-off; less accurate representation of inventory value. | Suitable for small businesses with minimal inventory or infrequent write-offs. |

| Allowance Method | Provides a more accurate representation of inventory value over time; smoother impact on financial statements. | More complex to implement; requires estimation of potential losses. | Suitable for businesses with significant inventory or frequent write-offs. |

| Cost of Goods Sold Method | Reduces the cost of goods sold, impacting profitability and potentially lowering tax liabilities. | May not accurately reflect the true value of the inventory loss if the write-off is due to reasons other than sales. | Applicable when inventory becomes unsaleable due to obsolescence or damage. |

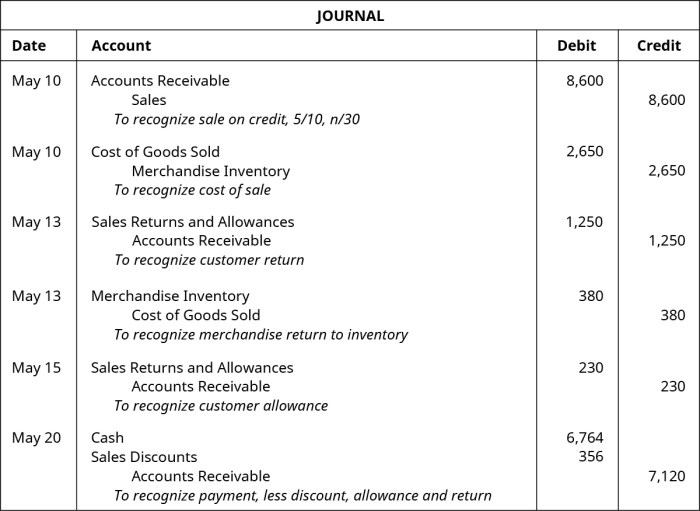

Journal Entries for Inventory Write-Off

Source: unizin.org

The journal entry for writing off inventory involves debiting an expense account (e.g., Loss on Inventory Write-Down or Cost of Goods Sold) and crediting the Inventory account. The specific account debited depends on the reason for the write-off. For obsolete inventory, the debit would be to Loss on Inventory Write-Down. For inventory lost due to damage or theft, the debit might be to an insurance recovery account if applicable, or to Loss from Damage/Theft.

Let’s consider a scenario where a business closes with $10,000 worth of unsold inventory.

When a business closes, writing off remaining inventory requires a debit to the cost of goods sold and a credit to the inventory account. This seemingly simple accounting entry highlights the finality of the business’s operations and underscores the importance of inventory management. Understanding this is crucial, especially considering the significant roles inventory plays in a successful business, as detailed in this helpful article: 4 important roles of inventory to a business.

Proper inventory control is essential for accurate financial reporting, even during the closing process. Therefore, the write-off entry ensures the financial statements reflect the reality of the business’s complete cessation.

Example:

To write off $10,000 of unsold inventory:

Debit: Loss on Inventory Write-Down $10,000

Credit: Inventory $10,000

Impact on Financial Statements

Writing off inventory significantly impacts a business’s financial statements. On the income statement, the write-off increases the cost of goods sold, thus reducing net income. On the balance sheet, the inventory account decreases, and retained earnings are reduced by the amount of the loss. The statement of cash flows is not directly impacted by the write-off, as it’s a non-cash transaction.

However, the reduced net income may indirectly affect financing activities if it influences borrowing decisions.

- Decrease in Inventory on the Balance Sheet

- Increase in Cost of Goods Sold on the Income Statement

- Decrease in Net Income on the Income Statement

- Decrease in Retained Earnings on the Balance Sheet

Tax Implications of Inventory Write-Off, Accounting entry to write off inventory when business closes

Inventory write-offs have significant tax implications. The loss resulting from the write-off is generally deductible for tax purposes, potentially reducing the business’s overall tax liability. However, regulations and limitations may exist regarding the deductibility of inventory losses. The Internal Revenue Service (IRS) or relevant tax authorities have specific rules and documentation requirements that must be followed to claim these deductions.

For example, the write-off must be substantiated with proper documentation, such as an inventory valuation report showing the decline in value.

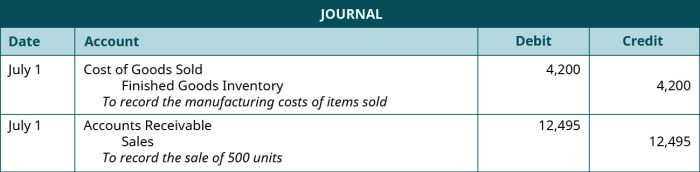

Documentation and Reporting Requirements

Source: unizin.org

Supporting documentation for inventory write-offs is crucial for tax purposes and financial reporting. This includes an inventory valuation report, which details the inventory’s cost, quantity, and current market value. Detailed records explaining the reasons for the write-off (obsolescence, damage, theft) are also necessary. Financial statements must clearly disclose the inventory write-off, its amount, and the reasons behind it.

This ensures transparency and compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

Detailed FAQs

Can I write off inventory that’s simply outdated but still functional?

Yes, if the inventory is deemed obsolete due to market changes or technological advancements, rendering it unsaleable, it can be written off. Proper justification is needed.

What if I have partial inventory damage? Do I write off the whole lot?

No, only the portion of the inventory deemed unusable or unsaleable due to damage should be written off. The remaining portion should be valued accordingly.

Are there any specific deadlines for reporting inventory write-offs related to business closure?

Deadlines vary depending on your jurisdiction and tax regulations. Consult with a tax professional or relevant authorities to ensure compliance.

What happens if I don’t properly document the inventory write-off?

Lack of proper documentation can lead to complications during audits and potential tax penalties. Maintaining detailed records is crucial.