Tax Implications of an $80,000 Inventory Sale

A business taxpayer sells inventory for 80 000 – Selling inventory for $80,000 has significant tax implications for a business. The tax liability depends heavily on the inventory costing method used (FIFO, LIFO, or weighted average), as this directly impacts the calculation of the Cost of Goods Sold (COGS) and subsequently, the gross profit.

Inventory Costing Methods and Tax Liability

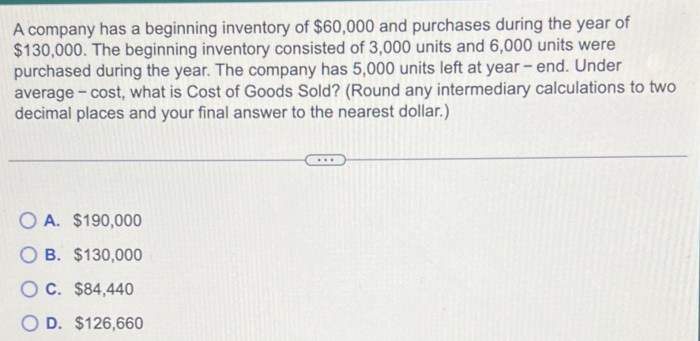

The choice of inventory costing method significantly affects the reported COGS and, consequently, the taxable income. Let’s examine how each method impacts the $80,000 sale:

- FIFO (First-In, First-Out): Assumes the oldest inventory items are sold first. If the cost of the oldest inventory was significantly lower than current costs, this method would result in a lower COGS and higher taxable income compared to other methods.

- LIFO (Last-In, First-Out): Assumes the newest inventory items are sold first. In inflationary environments, this leads to a higher COGS and lower taxable income compared to FIFO. LIFO is not permitted under IFRS.

- Weighted Average Cost: Calculates the average cost of all inventory items and applies this average cost to the goods sold. This method provides a middle ground between FIFO and LIFO, resulting in a COGS and taxable income that falls somewhere between the two.

For example, let’s assume the COGS under FIFO is $50,000, under LIFO is $60,000, and under the weighted average method is $55,000. This results in gross profits of $30,000, $20,000, and $25,000 respectively. The tax liability will vary accordingly, based on the applicable tax rate.

Calculating Tax Liability

The calculation of tax liability involves subtracting the COGS from the sales revenue to determine the gross profit. This gross profit is then subject to the business’s applicable tax rate. Additional deductions and expenses further reduce the taxable income. The specific tax forms and schedules required will depend on the business structure and jurisdiction. Form 1120 (U.S.

Corporation Income Tax Return) or Schedule C (Profit or Loss from Business) are common examples.

Impact on Business Profitability

The $80,000 inventory sale directly impacts the business’s profitability for the accounting period. It increases revenue and, depending on the COGS, significantly impacts net income. A higher gross profit leads to higher net income, potentially increasing the business’s overall profitability. This increased profitability could fund future growth, expansion, or reinvestment opportunities. Conversely, a lower gross profit due to high COGS may necessitate a review of inventory management and pricing strategies.

When a business taxpayer sells inventory for 80,000, it’s crucial to understand the accounting implications. Properly managing this requires a clear grasp of the three key inventory accounts, as detailed in this helpful resource on 3 inventory accounts for a manufacturing business. This understanding ensures accurate cost of goods sold calculations and ultimately, a correct reflection of the 80,000 sale in the company’s financial statements.

Profit and Loss Statement Illustration, A business taxpayer sells inventory for 80 000

A simplified profit and loss statement illustrates the impact of the $80,000 sale:

| Revenue | COGS (FIFO) | Gross Profit | Net Income (after other expenses) |

|---|---|---|---|

| $80,000 | $50,000 | $30,000 | $20,000 (example) |

Note: This is a simplified illustration. Actual net income will depend on other operating expenses, interest, taxes, etc.

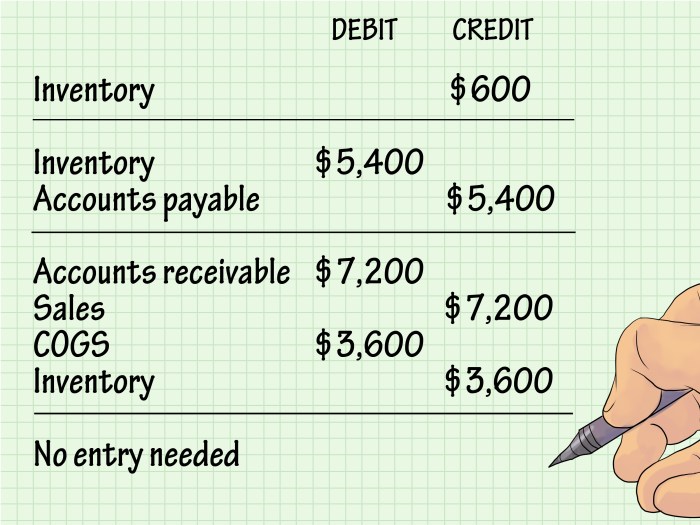

Accounting Treatment of the Sale

The sale of inventory requires several journal entries to accurately reflect the transaction in the business’s financial records.

| Account | Debit | Credit | Description |

|---|---|---|---|

| Cash/Accounts Receivable | $80,000 | Increase in assets from the sale | |

| Sales Revenue | $80,000 | Increase in revenue | |

| Cost of Goods Sold | $50,000 (example using FIFO) | Expense related to the sale | |

| Inventory | $50,000 (example using FIFO) | Decrease in inventory value |

Potential Tax Deductions and Credits

Source: cheggcdn.com

Several tax deductions and credits might be applicable, depending on the specific circumstances. These could reduce the overall tax liability. Examples include depreciation (for equipment used in the production or sale of inventory) and Section 179 expensing (allowing immediate deduction of certain capital expenses). Eligibility for these deductions depends on specific regulations and requirements Artikeld in the tax code.

Consulting a tax professional is crucial to determine eligibility for any applicable deductions or credits.

Scenario Variations and Their Impact

Source: wikihow.com

Let’s compare the tax implications if the inventory was sold for $60,000 instead of $80,000.

| Sale Price | COGS (FIFO) | Gross Profit | Potential Tax Liability (example) |

|---|---|---|---|

| $80,000 | $50,000 | $30,000 | $X (based on tax rate) |

| $60,000 | $50,000 | $10,000 | $Y (lower than X) |

Selling at a loss (where COGS exceeds revenue) results in a different accounting treatment and may allow for specific tax deductions to offset the loss. It’s important to consult a tax professional to understand the implications of selling inventory at a loss.

Question Bank: A Business Taxpayer Sells Inventory For 80 000

What if the inventory was damaged before sale, affecting its value?

The sale price would be adjusted to reflect the diminished value, impacting COGS and ultimately the tax liability. Proper documentation of the damage is crucial.

How does this sale impact the business’s cash flow?

The $80,000 sale will increase the business’s cash flow (if paid in cash) or accounts receivable (if sold on credit), improving liquidity.

Are there penalties for incorrectly reporting this sale?

Yes, inaccurate reporting can lead to penalties and interest charges from the tax authorities. Accurate record-keeping is paramount.

Can I deduct the cost of marketing and advertising related to this inventory sale?

Potentially, yes. Marketing and advertising expenses directly related to the sale of this specific inventory may be deductible as selling expenses.